does td ameritrade report to irs

Can I enter K1 in turbotax and click the IRA for the K1 to do the taxes. Effortlessly add and underline text insert images checkmarks and signs drop new fillable fields and rearrange or delete pages from your document.

Charles Schwab Completes Its 22b Purchase Of Td Ameritrade

You pay tax on it if you profit income tax rate if short term capital gains.

. Steps to access your T5 through online banking. The topic of this. Edit irs form w 8ben td ameritrade.

Intraday data is delayed at least 20 minutes. Under the Documents listing locate your T5. TD Ameritrade does not report this income to the IRS.

Since January 1 2013 brokers are required to report options trades to the IRS. Understanding Form 1040. Does Ameritrade report to the IRS.

The custodian bank is charged with safeguarding your financial assets to report required information to the IRS eg 1099s etc and provide you statements of your holdings. Have you talked to a tax professional about this. TD Ameritrade will not report cost basis information on tax-exempt accounts to the IRS.

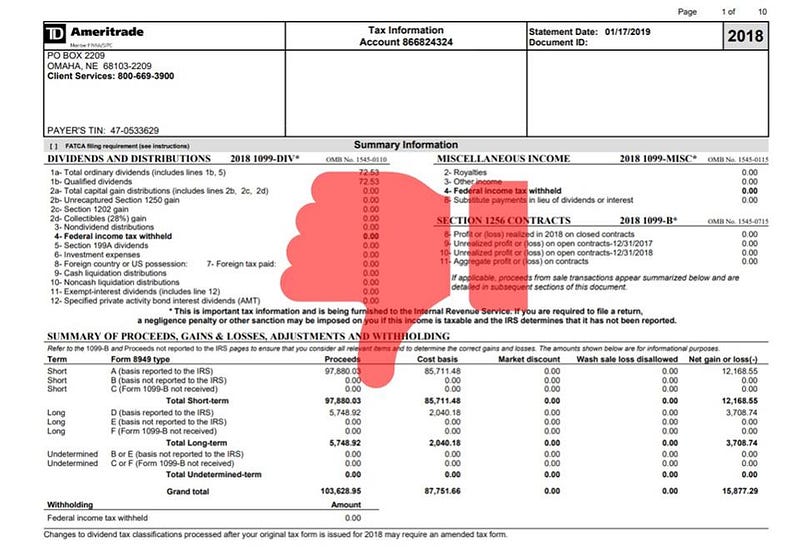

Document ID Number What does TD Ameritrade report to IRS-----The most important part of our job is creating informational content. Like options-trading strategies the tax treatment of options trades is far from simple. My TD Ameritrade Tax Statement shows.

Under the My Accounts list in the left hand column click View e-Documents. Individual Tax Return Form 1040 needs to be filed with the IRS by April 15 in most years. TDAmeritrade says IRS wants to tax the Schedule K1 in IRA unrelated business taxable income.

Anything else you want the. Have you talked to a tax professional about this.

Is Td Ameritrade Safe Legit Is Td Ameritrade A Scam 2022

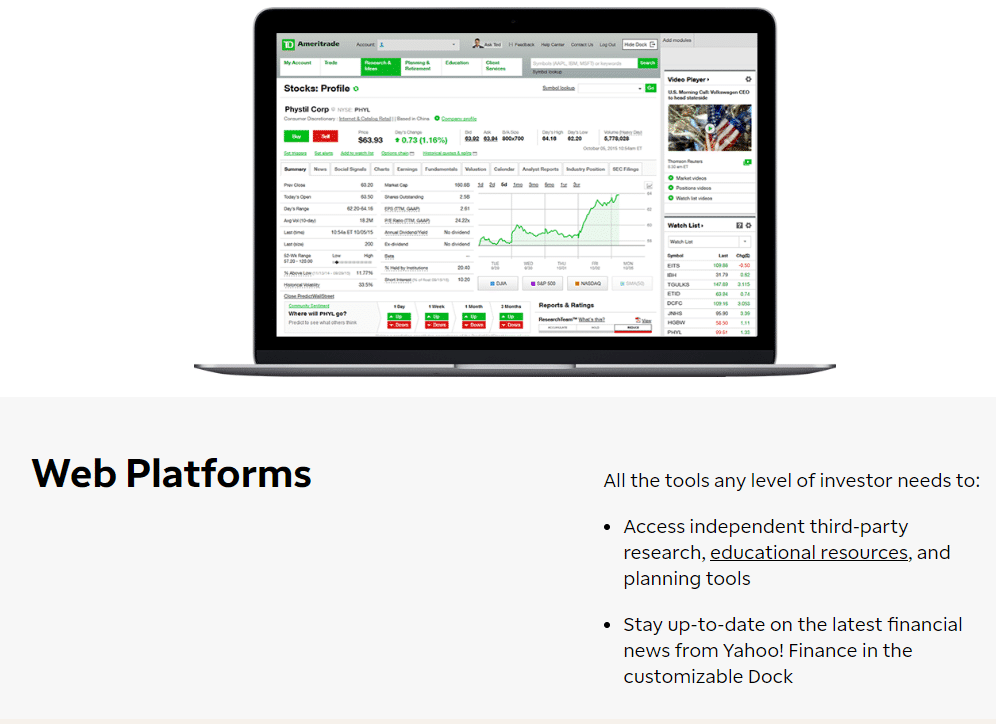

Td Ameritrade Review A Robust Investing Platform

Td Ameritrade Foreign Application Filling Up Irs W 8ben And Trusted Contacts Part 3 Youtube

Td Ameritrade Review A Leading Online Stock Broker

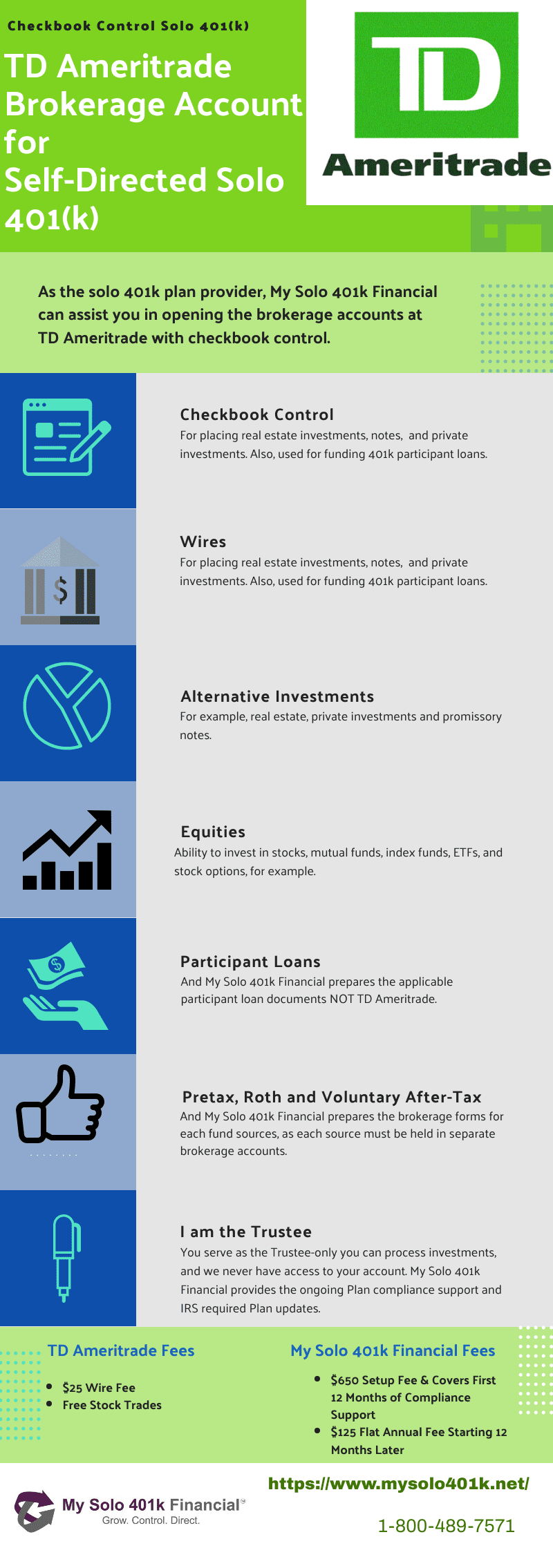

Ameritrade Solo 401k My Solo 401k Financial

1040s 1099s Other Federal Tax Forms What You Mig Ticker Tape

How To Read Your Brokerage 1099 Tax Form Youtube

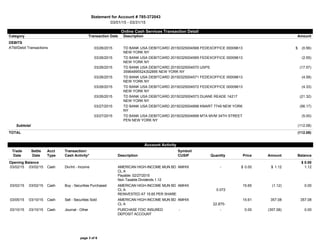

Mr Rjb Jr S Td Ameritrade Statements March 2015 06 18 2015

Get Real Time Tax Document Alerts Ticker Tape

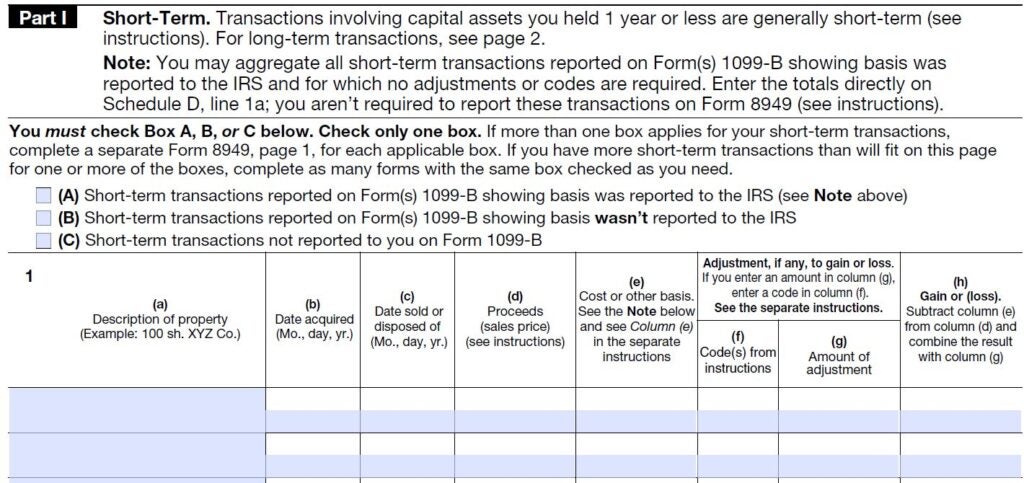

What Is Schedule D How To Report Capital Gains And Losses

Deciphering Form 1099 B Novel Investor

Schedule D How To Report Your Capital Gains Or Losses To The Irs Bankrate

I Emailed Td Ameritrade And Asked Why They Tried To Claim I Bought My Gme Prior To 2011 When They Drs D My Shares That S Why It Shows Non Covered They Still Claim Cs

Schedule D How To Report Your Capital Gains Or Losses To The Irs Bankrate

Need To Report Cryptocurrency On Your Taxes Here S How To Use Form 8949 To Do It Bankrate

Charles Schwab To Buy Td Ameritrade For 26 Billion Reports Say Investmentnews

Td Ameritrade Review A Leading Online Stock Broker

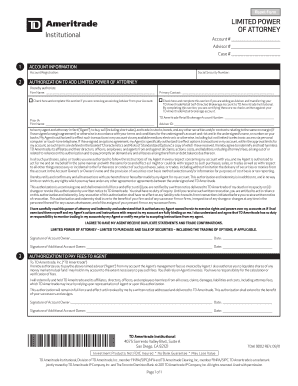

Fillable Online Td Ameritrade Limited Power Of Attorney Strategic Money Report Fax Email Print Pdffiller

Are You Considering These 4 Things When Choosing A Crypto Tax Software Cointracker